New Home Warranty

Protecting your most important investment

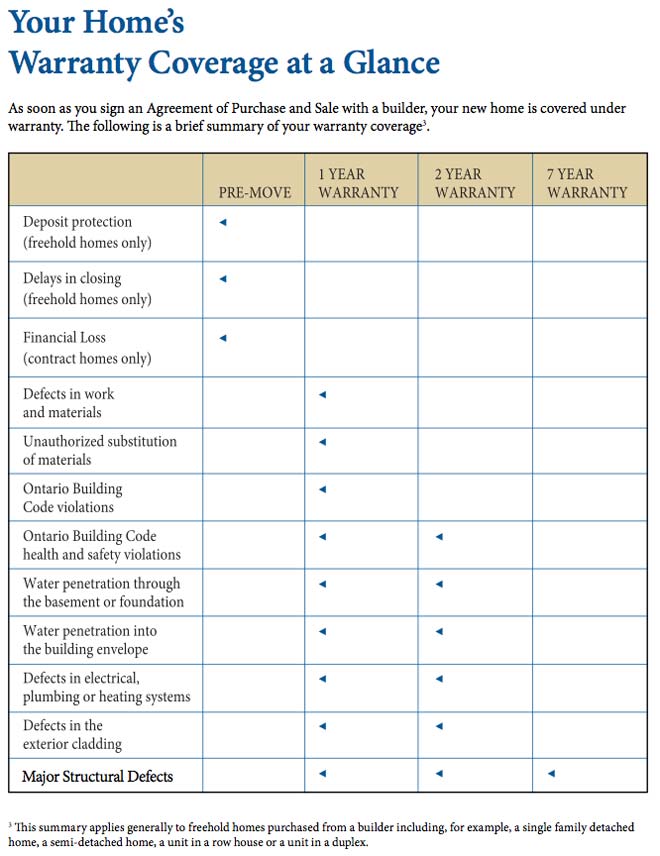

Your new home must meet or surpass the structural requirements and health and safety standards of the Ontario Building Code. And like every new home in Ontario, it is protected by mandatory warranties provided by your builder and backed by Tarion Warranty Corporation (“Tarion”).

Your new home must meet or surpass the structural requirements and health and safety standards of the Ontario Building Code. And like every new home in Ontario, it is protected by mandatory warranties provided by your builder and backed by Tarion Warranty Corporation (“Tarion”).

Tarion is a non-profit, private corporation established in 1976 to protect the rights of new home buyers and regulate new home vendors and builders1 according to the terms of the Ontario New Home Warranties Plan Act (the “Act”). Not only does the Act require builders in Ontario to provide new home warranty coverage, but they must also be registered with Tarion and enrol every new home prior to the start of construction. Tarion is also responsible for managing a guarantee fund to ensure that builders honour the statutory warranties2, and for enforcing the overall terms of the Act.

Moving into your new home is an exciting and busy time, however, it is important that you set aside some of that time to carefully read through and understand your rights and responsibilities when it comes to your new home’s warranty. Here, you’ll find all you need to know about your home’s statutory warranties, the responsibilities of both you and your builder, and how Tarion handles statutory warranty claims.

If you are unsure about your rights under your purchase agreement or the Act, you may wish to seek the advice of a lawyer.

If you have questions that you cannot find answers to on our website, call us at 1-877-9TARION (1-877- 982-7466).

Freehold Home vs. Contract Home

For the most part, purchase of a freehold home, (i.e., lot and dwelling) and contract home, (i.e., contract to build just a new dwelling) are treated the same — although there are some differences.

Purchases of freehold homes involve situations where a purchaser has agreed in substance to buy both a parcel of land and a residential dwelling unit to be constructed on that parcel of land. Various types of dwellings fit this category, including a single family detached home, a semi-detached home, a unit in a row house or a unit in a duplex.

What is commonly called a contract home is different in that the land upon which the home is to be built is already owned by the landowner. The landowner has simply entered into a contract with a builder who will build a new home on that property. The various differences in treatment of these two forms of new home purchase are discussed in this Homeowner Information Package but a few important differences can be summarized as follows:

- A new freehold home purchase has deposit protection.

- Contract homes on the other hand do not have deposit protection or delayed closing compensation.

- Instead of deposit protection, contract home arrangements have protection against financial loss. In general terms this provides protection for any losses suffered by the owner should the builder fail to complete the home.

- A new freehold home has delayed closing protection. If closing, (i.e., transfer of title and occupancy) is delayed beyond permitted delays, compensation may be payable.

- For contract homes, since the landowner already controls access to the land in a contract home situation, the idea of delayed closing, (i.e., transfer of title) protection is inapplicable.